Transfer pricing rules seek to ensure that transactions between Related Parties are carried out on an arm’s length basis, as if the transaction was carried out between independent parties. To prevent the manipulation of Taxable Income, various articles in the Corporate Tax Law require that the consideration of transactions with Related Parties and Connected Persons needs to be determined by reference to their “Market Value”.

- Our Mission

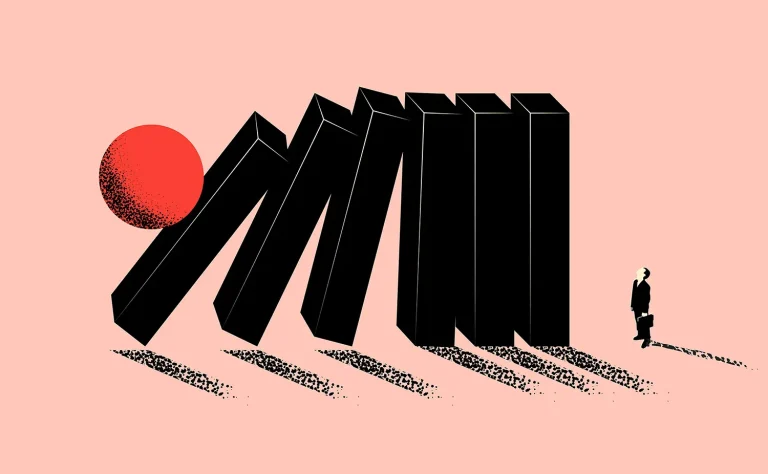

In today's interconnected business landscape, multinational enterprises (MNEs) face complex challenges in managing transactions with related parties across different jurisdictions. At Finaxis Global, we understand the importance of navigating transfer pricing regulations effectively to ensure compliance and mitigate tax risks. Our team of seasoned professionals specializes in providing comprehensive transfer pricing solutions tailored to the unique needs of our clients.

Transfer pricing rules are designed to ensure that transactions between related parties are conducted at arm's length, reflecting the fair market value as if the parties were independent entities. These rules aim to prevent the manipulation of taxable income and ensure fair taxation across borders.

- Our Capabilities

Our Services

Arm’s Length Principle

We ensure that transactions between related entities are priced in accordance with the arm’s length principle, reflecting fair market value as if conducted between independent parties.

Transfer Pricing Compliance

We provide tailored solutions to ensure compliance with transfer pricing regulations, including documentation preparation, analysis, and submission.

Transfer Pricing Planning

Our team offers strategic transfer pricing planning services to optimize tax efficiency and mitigate risks associated with cross-border transactions.

Transfer Pricing Audits & Risk Assessment

We conduct transfer pricing audits and risk assessments to identify potential issues and develop proactive strategies to address them.

Transfer Pricing Dispute Resolution

In the event of transfer pricing disputes, we offer expert support and representation to resolve disputes with tax authorities effectively.

Transfer Pricing Training and Education

We provide training and educational programs to help businesses understand transfer pricing regulations and implement best practices within their organizations.

- Get a Consutation

Partner with Finaxis Global

Stay ahead of the curve and ensure compliance with transfer pricing regulations under the Corporate Tax Law with Finaxis Global’s expert guidance and tailored solutions. Contact us today to learn more about how we can support your transfer pricing needs and help you achieve your business goals in the global marketplace.